The lender assumes the risk for lending you money. As a result, these have more stringent credit requirements and higher down payment requirements.

The government backs the loan, or assumes the risk for lending you money. These typically have lower credit and down payment requirements to make it easier for you to obtain a mortgage, if you qualify.

FHA:

Purchase a home with as little as 3.5% down. Minimum Credit scores are 500 for 90% Financing and credit scores over 580 can do 96.5% financing

2 years removed from Chapter 7 Bankruptcy

3 years removed from Foreclosure

VA:

Provides 100% financing to eligible veterans, active duty members, reservists, National Guard members, and surviving spouses. No minimum credit score

USDA:

Requires no money down for eligible homes in rural areas. No minimum credit score.

Income limits apply along with property restrictions.

|

Once we determine the home loan that fits you best, you need to start gathering paperwork that shows your income, assets, and debts. These will help us to determine your creditworthiness; that is, how likely you are to pay the loan back.

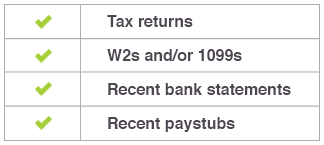

Some of those documents include:  |

|